https://www.facebook.com/ads/preferences/edit/

/nhttps://advertise.bingads.microsoft.com/en-us/resources/policies/personalized-ads

/nhttps://www.linkedin.com/psettings/advertising

/nhttp://www.youronlinechoices.com/uk/your-ad-choices for more information on common third party cookies used for targeted marketing.</p>\n","modalButton":"Save and close","overlayTitle":"We use cookies to give you the best browsing experience.","overlayText":"<p>We and our partners use cookies on our website to improve your browsing experience, personalize content and ads, provide social media features, and analyze our traffic. If you continue interacting we assume that you are happy to receive all cookies on this website. However, you can change your <span class=\"cookie-toggler\">cookie settings</span> at any time at the bottom of this page. Read more about our <a href=https://www.greenmatch.co.uk/"/cookie-policy/">cookie policy</a>.</p>\n","overlayButton":"Save and close"},"whyUse":{"title":"Why Use GreenMatch?"},"productGuide":{"back":"Back"},"page404":{"title":"Sorry, We Can't Find That Page","topText":"<div class=\"text shadow-container col-12 col-lg-10 col-xl-8 mb-4 p-3\">\n<p>…something went wrong or you might have followed an old link to a page that doesn’t exist anymore.</p>\n<p class=\"mt-3\">Were you looking for any of these by any chance?</p>\n<ul class=\"links\">\n<li><a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/solar-energy/solar-panels/">Solar Panels</a></li>\n<li><a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/heat-pumps/">Heat Pumps</a></li>\n<li><a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/boilers/">Boilers/n

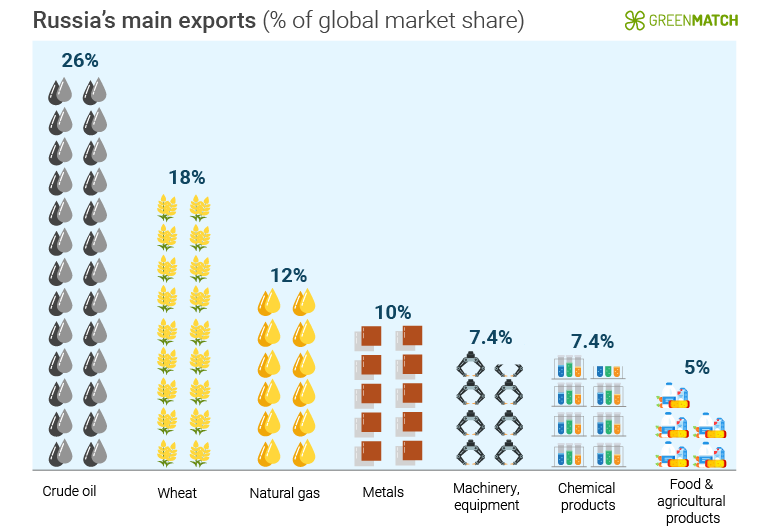

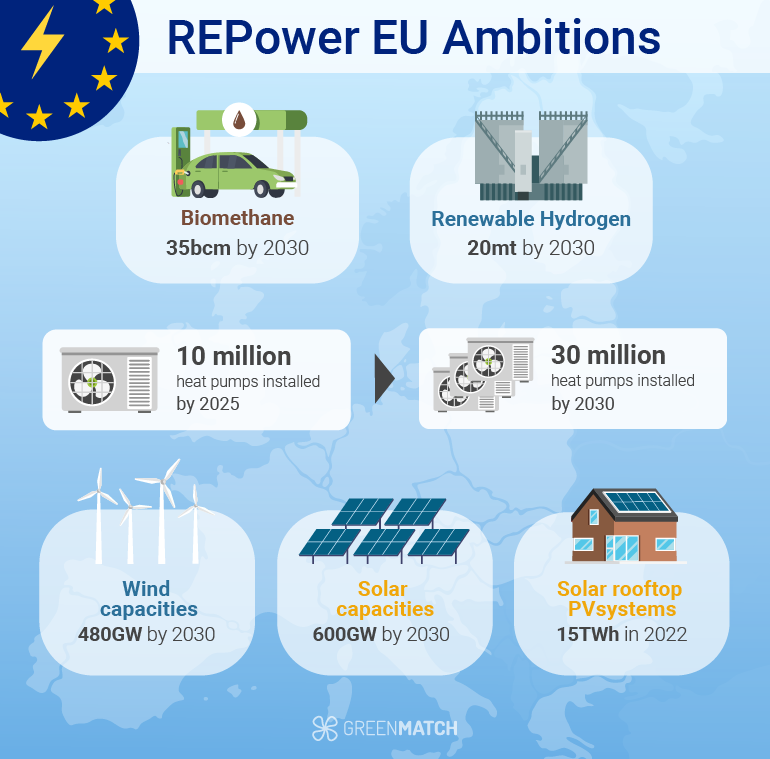

energy price cap</a> increase means the average household will pay <strong>£3,549</strong> on annual energy bills. This is <strong>triple</strong> the amount paid last year. And its projected that electricity and <a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/blog/gas-prices-uk/">gas prices will continue to increase</a> in 2023.</p>\n<p>This comes during a time when the UK is already facing <a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/blog/energy-prices-drive-inflation/">high inflation</a>, cost of living crisis and energy crisis instigated by the economy recovering from COVID-19 lockdown and less imported gas from Russia.</p>\n<p>As a result, many homeowners have found <strong>renewable energy</strong>— through <a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/solar-energy/solar-panels/">solar panels</a> & <a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/heat-pumps/">heat pumps</a>— to be the solution to becoming energy self-sufficient and independent of the gas and electricity grid.</p>\n'\n type='fact'\n />\n\n\n\n\n<p>These energy price surges will impact low-income, <strong>fuel poor households most severely</strong>, which spend <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://www.resolutionfoundation.org/comment/the-cost-of-living-crisis-is-going-to-hurt//" target=\"_blank\">three times more</a> of their household <strong>budgets on energy bills</strong> than the richest 20% of households. The UK government is now investing 1 billion pounds to the new <a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/blog/uk-government-launches-1-billion-scheme-to-insulate-more-homes/" title=\"UK Government Launches 1 Billion Scheme to Insulate More Homes\">ECO+ scheme</a> that is expected to launch in 2023.</p>\n\n\n\n<p>Energy price increases in particular have renewed calls for a windfall profits tax on oil and gas companies after Shell reported record quarterly gains as a direct result of recent energy market volatility. A <strong>10% tax could raise £2 billion</strong>, which supporters say could go into bringing down the price of energy bills and help in providing basic needs, such as food.</p>\n\n\n\n<h2>The Impact of Energy Inflation</h2>\n\n\n\n<p>Over-dependence on <strong>fossil energy is directly contributing</strong> to the current inflation crisis. The biggest <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://www.statista.com/statistics/328540/monthly-inflation-rate-eu//" target=\"_blank\">contributor to the combined</a> Euro area headline inflation is energy inflation. The rise of inflation in the Euro area is reflected in the energy price rise in many countries.</p>\n\n\n<div class=\"wp-block-image\">\n<figure class=\"aligncenter\"><img loading=\"lazy\" width=\"770\" height=\"335\" src=https://www.greenmatch.co.uk/"https://cdn.greenmatch.co.uk/cdn-cgi/image/format=auto/2/2022/10/inflation_factors_euro_area.png/" alt=\"Inflation Factors and Their Contribution\" class=\"wp-image-62625\" /></figure></div>\n\n\n<p>The cost of fossil energy sources will <strong>continue to increase for as long as we rely on them</strong>. However, following similar measures from the UK and US, the EU has announced it will reduce the supply of Russian gas by <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://ec.europa.eu/commission/presscorner/detail/en/ip_22_1511/" target=\"_blank\">two-thirds by the end of 2022</a>, in response to the military attack on Ukraine.</p>\n\n\n\n<p>Rapidly diverging from current fossil energy sources strains global demand and causes fossil energy prices to hike. What’s more, <strong>current market conditions allow energy</strong> producers to drive up the cost of importing energy, which is then passed on to consumers.</p>\n\n\n\n<p>Governments must fast-track a policy landscape that front-loads production of <a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/blog/low-carbon-heating/" title=\"Low Carbon Heating\">low carbon heating systems</a>, renovates infrastructure, and establishes an equitable market.</p>\n\n\n\n<h2>Demand for Natural Gas Ignites a Crisis</h2>\n\n\n\n<p><a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/blog/gas-prices-uk/" title=\"Gas Prices UK\">Rising gas prices</a>, as well as straining energy demands across the industrial sector, puts pressure on the cost of living for households as competing primary consumers.</p>\n\n\n\n<p>Natural gas makes up over <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://www.ecb.europa.eu/pub/economic-bulletin/focus/2022/html/ecb.ebbox202201_04~63d8786255.en.html/" target=\"_blank\">25% of energy use</a> in the Euro area, making it the second-largest energy resource, following petroleum. In 2019, 90% of the gas consumed by the bloc was imported. Together with petroleum products, making up <strong>64% of total energy imports to the euro area</strong>.</p>\n\n\n\n<p>Natural gas consumption increased in Europe by <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://iea.blob.core.windows.net/assets/4fee1942-b380-43f8-bd86-671a742db18e/GasMarketReportQ32021_includingGas2021Analysisandforecastto2024.pdf/" target=\"_blank\">25% by June 2021</a>, the largest year-on-year increase since 1985.</p>\n\n\n\n<p>This increase was the result of lower temperatures in April, prolonging the usual heating season for households. <strong>Demand was further bolstered</strong> by improving global economic activity, emerging close to pre-pandemic levels in the commercial and service sectors.</p>\n\n\n\n<p>These heating and industrial requirements also <strong>increased demand for electricity</strong>. Power generation relies on the flexibility of gas-fired power plants to respond quickly to demand surges. The output of gas-fired power plants increased <strong>25% by June 2021</strong>, spiking in April up to 65% as a result of heating demand pressures.</p>\n\n\n\n<p>The inflationary surge of electricity is directly linked to rising oil and gas prices since gas makes up 22% of electricity production. <strong>By March 2022</strong>, the retail price for gas and electricity rose 65% and 30% respectively, from the previous year.</p>\n\n\n<div class=\"wp-block-image\">\n<figure class=\"aligncenter\"><img loading=\"lazy\" width=\"730\" height=\"330\" src=https://www.greenmatch.co.uk/"https://cdn.greenmatch.co.uk/cdn-cgi/image/format=auto/2/2022/10/oil_storage.jpg/" alt=\"Oil Storage\" class=\"wp-image-62626\" /></figure></div>\n\n\n<h3>Global Demand for LNG Cargoes</h3>\n\n\n\n<p>Liquefied natural gas (LNG) demand soared as a result of these heating and production demands in Europe and Asia. This increased global competitiveness and was a primary cause for spot shipping prices to surge up to an <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://www.iss.europa.eu/sites/default/files/EUISSFiles/Brief_2_Energy Crisis.pdf/" target=\"_blank\">all-time high of $200,000</a><strong>, early in 2021</strong>.</p>\n\n\n\n<p>In China especially, limited oil supplies meant demand for natural gas consumption <strong>rose 17%</strong> from the previous year during this period in 2021. This gave way to a 28% increase in LNG cargoes in the first half of 2021.</p>\n\n\n\n<p>Usual LNG supplies to Europe from the US were strained following extreme freezing in Texas, <strong>increasing competitiveness</strong> with Asian markets for precious cargoes.</p>\n\n\n\n<p>Supplies of LNG were also limited during the summer months. Droughts in South America restricted renewable hydropower capacities which further diverted LNG supplies to Europe at a time when summer heatwaves dictated demands for air-conditioning across the global market.</p>\n\n\n\n<p>Lagging winds also reduced hydropower capacities in Europe and <strong>shifted demand to fossil sources</strong>. This was especially the case in the Netherlands and Germany, where wind power makes up to a fifth of their respective energy use.</p>\n\n\n\n<p>These seasonal inefficiencies in <strong>renewable power generation strengthened</strong> the reliance on oil and gas, constraining supply-demand dynamics and becoming a leading factor in the current crisis.</p>\n\n\n<div class=\"wp-block-image\">\n<figure class=\"aligncenter\"><img loading=\"lazy\" width=\"730\" height=\"330\" src=https://www.greenmatch.co.uk/"https://cdn.greenmatch.co.uk/cdn-cgi/image/format=auto/2/2022/10/gas_pumps.jpg/" alt=\"Gas Pumps\" class=\"wp-image-62627\" /></figure></div>\n\n\n<h3>Plans to REPower the EU</h3>\n\n\n\n<p>Following the devastating attack on Ukraine, the EU announced its <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://ec.europa.eu/commission/presscorner/detail/en/ip_22_1511/" target=\"_blank\">REPower EU</a> ambitions. REPower EU is a series of EU or nationwide measures that aim to <strong>transform the energy market</strong> to bring a secure supply of <a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/blog/alternative-energy-sources/" title=\"Alternative Energy Sources\">energy that is sustainably produced</a> and affordable to consumers, a “trilemma” of interplaying factors, as research from the EUISS puts it.</p>\n\n\n\n<p>Russia is the world’s largest <strong>exporter of natural gas</strong> and the second-largest exporter of crude oil. In 2021, the EU imported more than 40% of its natural gas, and 27% of its oil from Russia. Since the start of the war, Europe received <strong>71% of Russia’s fossil fuel exports</strong>, directly funding the Kremlin’s war machine.</p>\n\n\n\n<p>Global supply shortages of major <strong>Russian-Ukrainian food exports</strong> such as wheat, corn and sunflower, and <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://tradingeconomics.com/russia/exports/" target=\"_blank\">other exports</a> such as metals and agricultural products, continue to drive up the price of commodities globally.</p>\n\n\n<div class=\"wp-block-image\">\n<figure class=\"aligncenter\"><img loading=\"lazy\" width=\"770\" height=\"530\" src=https://www.greenmatch.co.uk/"https://cdn.greenmatch.co.uk/cdn-cgi/image/format=auto/2/2022/10/russia_main_exports.png/" alt=\"Russian Exports\" class=\"wp-image-62628\" /></figure></div>\n\n\n<p>The REPower EU proposals address higher energy market prices and low gas storage supplies by establishing a largely self-sufficient EU-wide energy system. This aims to make Europe independent from Russian gas <strong>“well before” 2030</strong>.</p>\n\n\n\n<h3>Natural Gas Storage</h3>\n\n\n\n<p>Inefficient energy infrastructure increases market volatility and inflationary pressures, especially during the shift to renewable energy which relies on <strong>alternative base-load power supplies</strong> during supply shortages.</p>\n\n\n\n<p>In the EU, gas storage capacities typically supply <strong>25-30% of total natural gas consumption</strong> in the winter months. However, natural gas supplies across Europe fell to new lows across 2021. <br>What’s more, many EU member states rely on a single source for gas which risks steady supply during disruptions.</p>\n\n\n\n<p>This highlights the importance of reliable infrastructure to <strong>meet these gas system demands</strong> since this instability ultimately jeopardises the speed of the green transition and threatens energy security.</p>\n\n\n\n<p>In light of current supply shocks, the <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52022DC0138&qid=1649253932345\%22 target=\"_blank\" data-anchor=\"?uri=CELEX%3A52022DC0138&qid=1649253932345\">Commission</a> has proposed EU-wide common standards that allow for burden-sharing mechanisms between member states that increase preparedness.</p>\n\n\n\n<p>The proposals also set a minimum gas storage obligation of <strong>80% by 1 November 2022</strong>, and an annual obligation of <strong>90% by 1 October</strong> every year that follows. 13 EU member states currently hold these obligations.</p>\n\n\n\n<h2>Transforming Europe’s Electricity Market</h2>\n\n\n\n<p>Key to the REPower EU ambitions is optimising the electricity market to bring the lowest possible costs for electricity from renewable sources. This will greatly improve energy efficiency which reduces consumption, hardens the market and <strong>shields households from high prices</strong>. Establishing the necessary measures and investments in the medium term will reduce their payback time and sooner reduce energy bills.</p>\n\n\n\n<p>These measures could include incentivising efficiency through government-backed 0% loans for renovations and <a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/zero-vat-on-solar-panels-and-heat-pumps/" title=\"UK Announces Zero VAT on Solar Panels and Heat Pumps\">reduced VAT rates for energy-efficiency products</a>. Quick, short-term efficiency measures such as insulating roofs and attics are also <a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://www.eurima.org/uploads/files/modules/articles/1649865363_Eurima recommendations on REPowerEU.PDF/" target=\"_blank\">advised</a>.</p>\n\n\n\n<p>Short-term emergency measures such as temporary regulated price limits for consumers and liquidity support for businesses in energy-intensive industries provides necessary crisis relief. However, these market subsidies strengthen the <strong>EU’s reliance on foreign energy suppliers</strong>. Therefore, these must remain time-limited.</p>\n\n\n<div class=\"wp-block-image\">\n<figure class=\"aligncenter\"><img loading=\"lazy\" width=\"770\" height=\"330\" src=https://www.greenmatch.co.uk/"https://cdn.greenmatch.co.uk/cdn-cgi/image/format=auto/2/2022/10/heat_pump-1.png/" alt=\"Heat Pumps for Homes\" class=\"wp-image-62629\" /></figure></div>\n\n\n<h3>Improving Efficiency</h3>\n\n\n\n<p>Co-legislators to REPower EU have advised renovations for the most vulnerable buildings in the EU. This is with the aim of establishing EU-wide energy performance standards, affecting some 40 million buildings. Current ambitions only <strong>require upgrades up to grade E by 2033</strong>.</p>\n\n\n\n<p>In order to ensure maximum energy efficiency after widespread <a href=https://www.greenmatch.co.uk/"https://www.greenmatch.co.uk/heat-pumps/" title=\"Heat Pump\">heat pump</a> installation, the European Insulation Manufacturing Association (Eurima) clarified that all lower energy performance buildings, F and G class, require <strong>deep renovations to reach class C by 2030</strong>.</p>\n\n\n\n<p>Renovating Europe’s F/G class buildings to B/C class would reduce gas imports from Russia by 45%, Greenhouse researchers found.</p>\n\n\n\n<p>Financial support, such as subsidies, for these deep renovations must cover most, if not all, of the costs of deep renovations for <strong>vulnerable households</strong>.</p>\n\n\n\n<p>These can be funded through windfall profit taxes which the International Energy Association estimates could protect against energy prices by bringing <strong>€200billion in 2022</strong>. Additional funding can be sourced from revenues brought by the EU’s Emissions Trading System which generated €30billion in February 2022, from January the previous year.</p>\n\n\n\n<h3>REPower EU In a Nutshell</h3>\n\n\n<div class=\"wp-block-image\">\n<figure class=\"aligncenter\"><img loading=\"lazy\" width=\"770\" height=\"759\" src=https://www.greenmatch.co.uk/"https://cdn.greenmatch.co.uk/cdn-cgi/image/format=auto/2/2022/10/uk_repower_eu_ambitions.png/" alt=\"\" class=\"wp-image-62630\" /></figure></div>\n\n\n<p>The approach the plans will take partly comes from diversifying gas supplies and pipeline imports from non-Russian sources. This would involve sourcing an additional <strong>50 billion cubic metres (bcm) of LNG</strong> supplies from across the global market on a yearly basis.</p>\n\n\n\n<p>Biomethane production from sustainable sources is set to increase to 30bcm per year as well as an additional <strong>20 million tonnes of renewable hydrogens</strong>, through imports and domestic production. Hydrogen sources could replace <strong>25-50bcm of Russian gas by 2030</strong>.</p>\n\n\n\n<p>To support the hydrogen market ambitions, the EU Commission will develop a regulatory framework to integrate hydrogen within the existing cross-border gas infrastructure.</p>\n\n\n\n<p>REPower EU also aims to double photovoltaic and wind <strong>capacities by 2025</strong>, and triple them by 2030, saving 170bcm in yearly gas consumption by the end of the decade. This will require developments across the value chains of these technologies and <strong>front-loading emerging technologies</strong> through bloc-wide finance schemes.</p>\n\n\n\n<p>Ensuring faster permitting processes and upskilling the related workforces will also be critical to deploying these technologies.</p>\n\n\n\n<p>Overall, the EU plans to <strong>fully implement these ambitions</strong> by summer 2022. This would lower gas consumption by 30% by the end of the decade. Jointly these measures will bring the energy equivalent of at least 155bcm of Russian gas.</p>\n\n\n\n<p>Combatting the “<a rel=\"noopener\" href=https://www.greenmatch.co.uk/"https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220317_2~dbb3582f0a.en.html/" target=\"_blank\">new age of energy inflation</a>” requires rapid progress towards decarbonisation in the Euro area. Beyond ambition, this demands <strong>radical cross-sector policies and empowering of consumers</strong>. Sweeping efficiency measures, alternative energy supplies and widespread electrification will strengthen the EU’s energy network and minimise the worst effects on the most vulnerable households.</p>\n</div></div>\n","lastUpdated":"11 August 2023","topBanner":null,"pageHeader":{"title":"<strong>Making the UK greener,</strong> one house at a time","type":"text","subtitle":"","media_type":"testimonials"},"breadcrumbs":[{"name":"GreenMatch","url":"https://www.greenmatch.co.uk/"},{"name":"Blog","url":"https://www.greenmatch.co.uk/blog"},{"name":"Energy Prices Drive Inflation","url":null}],"authors":[{"id":42190,"url":"https://www.greenmatch.co.uk/authors/ciaran-wark","image":"https://cdn.greenmatch.co.uk/cdn-cgi/image/format=auto/2/2022/10/workplace-photo.jpeg","name":"Ciaran Wark","bio":"<p>Ciaran is a content writer at GreenMatch. Whether writing about sustainable aviation fuel or heat pumps, Ciaran has passion for informing readers about pivotal technologies that are reshaping our world.</p>\n","shortenedbio":"<p>Ciaran is a content writer at GreenMatch. Whether writing about sustainable aviation fuel or heat pumps, Ciaran has passion for informing readers about pivotal technologies that are reshaping our world.</p>\n","jobTitle":"Writer","email":"c.wark@leads.io","linkedIn":"https://www.linkedin.com/in/ciaran-wark-50b380194/","type":"contributor"}],"relatedArticles":[],"subPages":[],"topPages":[],"hideMoreOnThisTopic":false,"hideItsThatEasy":false,"hideBecomeAPartner":false,"hideContentHeader":false,"guideLinks":[]},"url":"/blog/energy-prices-drive-inflation","version":"ac2a83a8524e6253e8813eee7189a636"}">![]()

![]()

![]()

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?