Get up to 3 quotes by filling in only 1 quick form

Slash your energy bills by installing an energy efficient boiler

We’ve helped over 500,000 homeowners reduce their carbon footprint

- GreenMatch

- Boilers

- Global Boiler Statistics: 2024 Facts and Trends

Global Boiler Statistics: Key Insights and Trends for 2024 Revealed

Boilers are critical in the energy landscape, providing heat generation solutions for various industries and residential sectors. This means they play a role in converting water into steam, making them indispensable for power generation and heating systems.

Today, the market’s growth is driven by escalating energy demands, industrialisation, and the need for cleaner and more efficient heating solutions.

The global boiler market was valued at approximately £11.52 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. This is due to the increase in demand for heating equipment worldwide. It leads the industry to incorporate innovative technologies and eco-friendly practices to align with global energy and environmental goals.

Regarding regional growth, Asia Pacific dominated the market for industrial boilers in 2022, accounting for 41.8% of the global revenue share. The region is expected to witness the fastest CAGR of 5.6% over the forecast period, driven by rapid industrialisation and the steady growth of the manufacturing sector.

As we navigate the article, we will explore these statistics in greater depth, providing a comprehensive overview of the market’s critical aspects. Let’s explore the world of Global Boiler statistics together, uncovering the stories behind the numbers and understanding their significance in shaping our energy future.

Global Boiler Market Overview

The global boiler market is not just a collection of numbers; it’s a dynamic force shaping the future of energy consumption worldwide. The residential boiler market is expected to grow at a CAGR of 5.5% from 2023 to 2033, reaching approximately £43 billion.

In 2016, the domestic boiler market grew to 12.7 million units, with China recording the most dynamic market uptake, driven by the “coal to gas” policy. China is now the largest global market, with over 1.77 million boilers sold in 2016, and further dynamic growth is expected until 202.

Regional Analysis

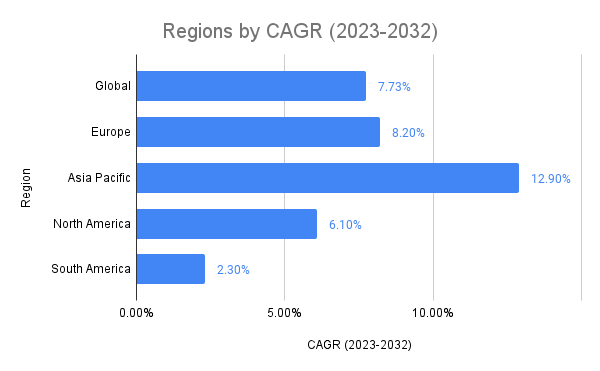

Asia-Pacific is estimated to be the fastest-growing region in the global boiler market, with countries like China and South Korea experiencing significant growth. The North American market remains a low consumer of domestic boilers, with around 400,000 units sold annually. However, the commercial boiler market size exceeded approximately £1.95 billion and is projected to depict a 6.1% CAGR from 2023 to 2032.

China is the largest commercial boiler market, with just over 92,500 units sold in 2016, followed by the North American market, and Turkey is the third largest market. The U.S. accounted for a considerable market share in 2022, with high disposable income and increasing population boosting the growth of numerous industries, including food and beverages, textile, and FMCG.

Key boiler statistics and facts based on analysis of key research from EPA and IEA

- The global industrial boiler market size was valued at approximately £11.5 billion in 2022 and is expected to reach approximately £16.8 billion by 2030, growing at a CAGR of 4.8%.

- The residential boiler market is expected to reach approximately £43 billion by 2033, growing at a CAGR of 5.5%.

- The global boiler market size exceeded £68.95 billion in 2022 and is projected to expand at a CAGR of more than 7.5% from 2023 to 2032

- China is the largest global market for domestic boilers, with over 1.77 million units sold in 2016.

- The UK is the third largest market for domestic boilers, with sales of 1.7 million units in 2016.

- The residential boiler market is expected to reach approximately £43 billion by 2033, growing at a CAGR of 5.5%.

- As of 2022, the global boiler market was valued at £10.6 billion.

- Regionally, North America accounted for the largest market share in 2023

- The fastest-growing region in the global boiler market is Asia-Pacific, which is estimated to grow at the highest CAGR over the forecast period (2023-2028)

- Asia Pacific held over 30% share of the global boiler market in 2022

- The U.S. residential boiler market is projected to be worth £5.925 billion by 2030

The market is expected to continue growing in the coming years, with Asia-Pacific being the fastest-growing region and China dominating the market. The market is also characterised by a diverse range of boiler types catering to different end-user sectors, with the industrial and residential sectors witnessing significant demand for boilers.

| Category | Details |

|---|---|

| Market Size (2022) | GBP 74.75 billion |

| Projected CAGR (2023-2032) | More than 7.5% |

| Key Players | Mitsubishi Power, Ltd., Valliant Group, Thermax Limited, A. O. Smith Corporation, Weil-McLain |

| Boiler Types Projected CAGR for Industrial Boiler Market (2023-2030) | Hot Water Boilers, Gas Boiler, Steam Water Boilers |

| End Users | Residential, Commercial, Industrial |

| Key Regions | North America, Europe, Asia-Pacific, Rest of the World |

| Fastest Growing Region | Asia-Pacific |

| Largest Market Share (2023) | North America |

| Residential Boiler Market Size (2023) | GBP 25.07 billion |

| Industrial Boiler Market Size (2022) | GBP 12 billion |

| Projected CAGR for Industrial Boiler Market (2023-2030) | GBP 16 billion |

| Market Trends | Transition from conventional fossil fuels to renewable and cleaner alternatives, increasing automation and robotics in manufacturing, and innovative boiler designs and functionalities |

Here is a data table summarising critical insights from the global boiler market:

| Market Segment | Market Size in 2022 (GBP Billion) | Projected Market Size in 2032 (GBP) | CAGR (2023-2032) | Key Insights |

|---|---|---|---|---|

| Global Boiler Market | £63.75 billion | 179 | 7.5% | Shift towards carbon-neutral and energy-efficient heating technologies and expanding industrial and commercial buildings. |

| Commercial Boiler Market | £3.13 billion | £4.16 billion | 4.9% | Rise in commercial buildings, increased safety for heating equipment, adoption of energy-efficient and cost-effective water systems |

| Residential Boiler Market | £9.195 billion | £15.525 billion | 6% | Increased demand for space and water heating systems, strict government regulations regarding carbon emissions, focus on energy efficiency |

| Industrial Boiler Market | £63.75 billion | £16.41 billion | 5.66% | Industrialization, energy demand, regulatory compliance, pursuit of efficient and environmentally friendly heating solutions |

| > 50 – 100 MMBtu/hr Boiler Segment | N/A | £7.5 billion | N/A | Growing implementation of tax incentives to boost the deployment of energy-efficient heating technologies |

Regional Analysis of Boiler Usage

The global boiler market was valued at approximately £64.5 billion in 2022 and is projected to grow to £142 billion by 2032, with a compound annual growth rate (CAGR) of 7.73%. This growth is driven by the introduction of strict regulations to mitigate carbon footprint and the shift towards carbon-neutral technologies, such as natural gas-fired boilers.

In addition, the market was divided into different types based on application, including residential, commercial, and industrial. The industrial segment is expected to dominate the market due to rising industrialization and increased investment in infrastructure for automotive and other industries.

The growth rate is expected to be at a CAGR of 4.8% from 2023 to 2030, reaching over £15 billion by 2030. This growth is driven by rapid industrialisation, the growing food and beverage industry, and stringent laws regulating harmful emissions.

Europe

Europe, along with the USA, accounts for the large market share in the world, and this trend is expected to continue in the coming years. The European boiler market was valued at approximately £33.5 billion in 2022 and is projected to expand at a CAGR of 8.2% from 2023 to 2032, reaching approximately £75.7 billion by 2032. This is due to the rising demand for residential boilers in developed countries such as Germany, France, and the UK.

In addition, the government’s stringent GHG emission control policies and the growing concern to reduce carbon emissions have bolstered the demand for energy-efficient boilers in Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing market for boilers, with countries like India and China becoming the world’s manufacturing hub. A large population presents lucrative growth opportunities to various industries, driving the demand for industrial boilers. The market size of the Asia-Pacific region is expected to grow rapidly in the coming years.

Today’s Asia Pacific electric boiler market was valued at approximately £1.7 billion in 2022 and is estimated to expand at a CAGR of 12.9% between 2023 and 2032, reaching approximately £5.7 billion by 2032. China held the largest market share, and India was the fastest-growing market in the Asia-Pacific region.

North America

North America is one of the largest markets for boilers, with the average capacity factor for industrial boilers at 47 per cent. The U.S. market is expected to experience consistent growth due to ongoing industrialization and surging investments toward expanding manufacturing facilities.

This is projected to expand at more than 8% CAGR from 2023 to 2032, reaching GBP 136.7 billion by 2032.

Central and South America

Countries like Brazil and Argentina are notable for their boiler usage in Latin America. The Central and South America region is projected to grow at a CAGR of 3.2% from 2023 to 2032.

Middle East & Africa

The Middle East & Africa region also shows significant boiler usage, with countries like Saudi Arabia, UAE, Egypt, Kuwait, and South Africa being key markets.

Boiler Usage by Type and Application

The global boiler market is a dynamic and diverse sector with many products and applications. Boilers can be segmented into various types, including oil and gas boilers, coal boilers, and biomass boilers. Gas-fired boilers are expected to grow significantly in the coming years, primarily driven by the growing demand for commercial and industrial applications.

Global Boiler, by Fuel Types

Boilers can be powered by various fuels, each with advantages and disadvantages. The most common fuel types include:

- Natural Gas: Natural gas boilers are popular due to their efficiency and lower emissions than other fossil fuels. They are also relatively inexpensive to operate.

- Oil: Oil-fired boilers are known for their high heat output and efficiency. However, they typically have higher emissions than natural gas boilers, and the cost of oil can fluctuate significantly.

- Coal: Coal-fired boilers are less common due to their high emissions and the environmental impact of coal mining. However, they are still used in areas where coal is abundant and cheap.

- Biomass: Biomass boilers use organic materials like wood pellets or agricultural waste as fuel. They are considered a renewable energy source and can be carbon-neutral if the biomass is sourced sustainably.

Global Boiler, by Types

Fire-tube boilers are the most common type, where hot gases pass through tubes surrounded by water. Water-tube boilers, on the other hand, have water flowing inside the tubes with hot gases surrounding them. Condensing boilers are designed to recover heat from exhaust gases, making them more energy-efficient than traditional boilers.

There are several types of boilers, each suited to different applications:

- Fire-tube Boilers: These boilers have a simple design and are typically used for low-pressure applications. They are relatively inexpensive and easy to operate.

- Water-tube Boilers: These boilers are used for high-pressure applications. They have a more complex design but are more efficient and have a higher capacity than fire-tube boilers.

- Electric Boilers: Electric boilers are highly efficient and have zero emissions at the point of use. However, they can be expensive to operate depending on electricity prices.

Boilers are used in various capacities, including

≤ 10 MMBtu/hr,

> 10 – 50 MMBtu/hr,

> 50 – 100 MMBtu/hr,

> 100 – 250 MMBtu/hr,

and > 250 MMBtu/hr.

The boiler market value from the > 50 – 100 MMBtu/hr capacity segment is anticipated to reach approximately GBP7.9 Billion by 2032.

Global Boiler, by Applications

Residential boilers are used for space heating and hot water supply in homes. In contrast, commercial boilers cater to the heating and hot water needs of offices, hotels, and other commercial establishments. Industrial boilers are used in manufacturing processes, such as food processing, chemical production, and textile manufacturing. Power generation boilers are used in power plants to produce steam for electricity.

The global residential boiler industry is poised to cross GBP 110.9 billion by 2032.

| Year | Residential Boiler Market (Billion GBP) | Industrial Boiler Market (Billion GBP) | Total Boiler Market (Billion GBP) |

|---|---|---|---|

| 2022 | 7.4 | 10.7 | 64.2 |

| 2023 | 7.7 | 11.2 | 67.8 |

| 2030 | 9.5 | 12.8 | 135.3 |

Boilers have a wide range of applications, including:

- Residential Heating: Boilers are commonly used for space heating in homes. They can heat through radiators, underfloor heating systems, or hot water baseboards.

- Industrial Processes: Boilers are used in various industries to provide steam or hot water for sterilization, cooking, and drying.

- Power Generation: In power plants, boilers generate steam that drives turbines to produce electricity.

The cost and efficiency of a boiler can significantly impact a household’s energy bills.

For example, new boilers are at least 90% efficient in the UK, while older boilers can be as low as 70% efficient. Upgrading from a D-rated boiler to an A-rated one could save a typical household up to 23% on their annual gas bills.

The table below provides an overview of potential savings for different boiler efficiency ratings:

| Efficiency Rating | Detached House | Semi-Detached House | Mid Terrace House | Flat |

| A (90% and above) | £375 | £305 | £235 | £125 |

| B (86-90%) | £410 | £330 | £255 | £135 |

| C (82-86%) | £445 | £360 | £275 | £145 |

| D (78-82%) | £480 | £390 | £300 | £160 |

| E (74-78%) | £460 | £335 | £260 | £140 |

| F (70-74%) | £590 | £380 | £290 | £160 |

| G (less than 70%) | £840 | £540 | £400 | £210 |

Global Boiler, by End Users

The main end users of boilers include:

- Residential: Homeowners use boilers for space heating and hot water supply.

- Commercial: Businesses, schools, hospitals, and other commercial buildings use boilers for space heating and hot water supply.

- Industrial: Industries like food processing, chemical, and pharmaceutical use boilers for various processes.

- Power Plants: Power plants use boilers to generate steam for electricity production.

Trends in Energy Efficiency and Sustainability Initiatives

The energy industry is undergoing a pivotal transformation, shifting towards more sustainable solutions and focusing on energy efficiency. This transformation is particularly evident in the boiler industry, where emerging technologies and the integration of the Internet of Things (IoT) drive growth and efficiency.

Boilers are a key component of heating systems, providing warmth throughout manufacturing facilities and commercial buildings. There are two types of boilers: those that produce hot water and those that produce steam, which is used to carry out the heating process.

Emerging boiler industry technologies focus on improving efficiency, reducing emissions, and integrating intelligent controls. Some of these technologies include:

- Low-NOx burners: These burners are designed to reduce nitrogen oxide (NOx) emissions, contributing to smog and acid rain.

- Flue gas desulfurization (FGD) systems: These systems remove sulfur dioxide (SO2) from flue gas, another major contributor to acid rain.

- Condensing boilers: One of the most significant advancements in boiler technology, condensing boilers recover heat from the flue gas, which can increase efficiency by up to 20%

- Predictive maintenance systems: These systems use data from sensors to identify potential problems before they cause an emissions event, helping to prevent emissions from exceeding limits and improving overall efficiency.

- IoT integration: IoT sensors enable remote monitoring and control of boiler equipment, allowing for real-time data access and optimization of boiler systems.

- Modular water tube boilers are compact, have lower emissions, and are more fuel-efficient than traditional fire tube boilers. They are becoming a viable option for companies of all sizes in various industries.

- Ultramizer® Advanced Heat Recovery Systems (AHRS): This technology uses a robust nanoporous membrane to selectively recover sensible and latent heat and pure water from natural gas combustion byproducts, avoiding corrosive condensate

- Hybrid boilers: These boilers combine traditional boilers with renewable energy sources, such as heat pumps or solar panels, to improve efficiency and reduce environmental impact.

- Micro-CHP boilers: Micro-CHP (combined heat and power) boilers generate electricity and heat by burning natural gas. This not only reduces reliance on the grid but also reduces energy bills.

- Biomass boilers: Designed to burn wood pellets or chips, these boilers offer a renewable and carbon-neutral heat source.

These advancements aim to make boilers more efficient, environmentally friendly, and cost-effective, catering to the growing demand for sustainable energy solutions in various industries.

The Rise of IoT and Intelligent Technologies

Integrating the Internet of Things (IoT) and intelligent technologies significantly impacts the boiler industry. IoT technology is revolutionising how boiler systems are monitored and controlled, leading to more efficient operations.

Real-time monitoring and analytics can be used to optimise boiler systems. At the same time, IoT sensors can track factors like temperature, flame strength, on/off cycles, and oxygen levels, uploading them to cloud platforms in real-time.

Predictive maintenance systems, which use data from sensors to identify potential problems before they cause an emissions event, are also being developed. These systems can help to prevent emissions from exceeding limits and improve the efficiency of boiler systems.

The Push for Sustainability

Sustainability is becoming a key focus for many companies, organisations, and government agencies, particularly within the utilities and energy sectors. The goal of each innovation is to decrease reliance on fossil fuels for energy, increase the use of renewable and distributed energy resources (DERs), and boost overall energy efficiency.

Boiler manufacturers are developing new technologies to reduce emissions from their products. These technologies include the use of low-NOx burners, which are designed to reduce the amount of nitrogen oxides (NOx) emitted from boilers, and flue gas desulfurization (FGD) systems, which remove sulfur dioxide (SO2) from flue gas.

The Power of Boiler Statistics

As we close our exploration of the power of boiler statistics, it’s clear that the boiler market is a dynamic and evolving landscape.

Understanding the global boiler market is crucial for businesses, investors, and policymakers. Reliable boiler statistics can inform decision-making, guide policy formulation, and highlight areas for innovation and improvement. As the boiler market evolves, staying abreast of key insights and trends is more important than ever.

This is not just about numbers; it’s about the real-world impact of these statistics. For instance, an inefficient boiler could cost you an extra £340 per year. On the other hand, upgrading your boiler from 56% to 90% efficiency could save 1.5 tons of carbon dioxide emissions each year if you heat it with natural gas or 2.5 tons with oil.

Boilers play a crucial role in the safe and effective production of food items during food processing. The rise in output and sales in the food and beverage industry is expected to support the growth of the global boiler market.

In addition, the market is also about innovation and adaptation. The shift towards more sustainable, low-carbon heating alternatives is a key trend in the industry. Biomass boilers, for instance, are an excellent ecologically friendly option for space and process heating in various industrial and commercial applications.

The boiler market is not just a national concern; it’s a global one. The Asia Pacific region, for example, held over 30% share of the global boiler market in 2022. The residential boiler market, for instance, is expected to grow from £23.5 billion in 2022 to £40.1 billion in 2033, recording a CAGR of 5.5%. This growth is driven by the increasing application of residential boilers in apartments and villas and the growing technological advances.

The boiler insurance market in the UK is also expected to grow significantly, from £420 million in 2022 to £860 million by 2027, growing at a CAGR of more than 15%

The Future of the Boiler Industry

The future of the boiler industry looks promising, with a focus on sustainability and energy efficiency. Integrating IoT and intelligent technologies will continue to drive industry growth and efficiency. At the same time, the shift towards more sustainable energy solutions will help create a more sustainable future for the energy industry.

As the Global Boiler Market report says, “The demand for boilers is rising due to rising investments in several industries… The market is expected to expand more due to the growing need for energy-efficient systems.”

These insights can guide decisions about when to replace boilers, potentially extending their lifespan and improving their efficiency. They are a powerful tool for decision-making and policy formulation, providing insights into efficiency, economic impact, and the potential for reducing carbon emissions.

As we move towards a more sustainable future, these statistics will be an invaluable guide, helping us to make informed decisions that benefit not just individual households or businesses but the planet as a whole.

This is because the boiler industry is at the forefront of the energy sector’s transformation towards sustainability and efficiency. With the integration of emerging technologies and IoT, the industry is set to continue its growth trajectory, contributing to a more sustainable and energy-efficient future.

So, let’s harness the power of boiler statistics. Let’s use them to guide our decisions, shape our policies, and create a future that is not only more efficient and economical but also more sustainable.

As we move forward, let’s harness the power of these statistics to drive innovation and growth in the global boiler market.

Remember, as the adage goes, “Knowledge is power”. So, let’s use the power of boiler statistics to make informed decisions and shape a more sustainable future.

Inemesit is a seasoned content writer with 9 years of experience in B2B and B2C. Her expertise in sustainability and green technologies guides readers towards eco-friendly choices, significantly contributing to the field of renewable energy and environmental sustainability.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?